Introducing Our New Loan Assignment Business Model

For over a year, Scramble has been actively collaborating with food and beverage brands in the dynamic UK market. This choice was deliberate, given the market's resilience amid geopolitical shifts. However, our location in the EU posed legal constraints, leading to the adoption of a classic crowdfunding model. In this model, Scramble facilitated the brand selection and cash flow, with contracts directly between investors and brands. Our new enhanced model offers improved integration into the UK's domestic loan contract protections and regulations. Simultaneously, it maintains full compliance with both EU and Estonian regulations tailored for retail investors. For a thorough understanding of the reasons behind this transition, refer to our detailed explanation in the previous article.

A Schematic Overview of A New Business Model

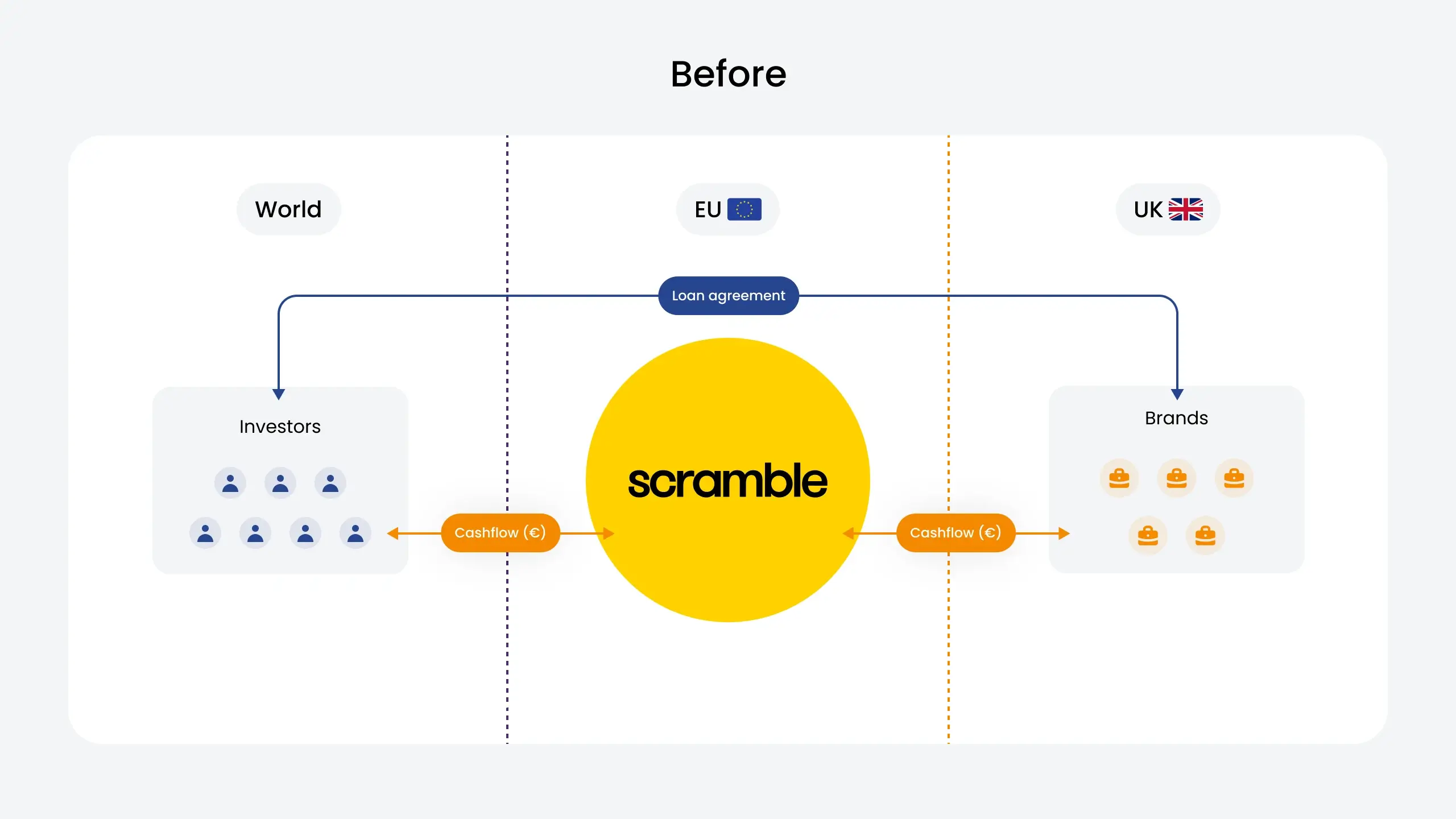

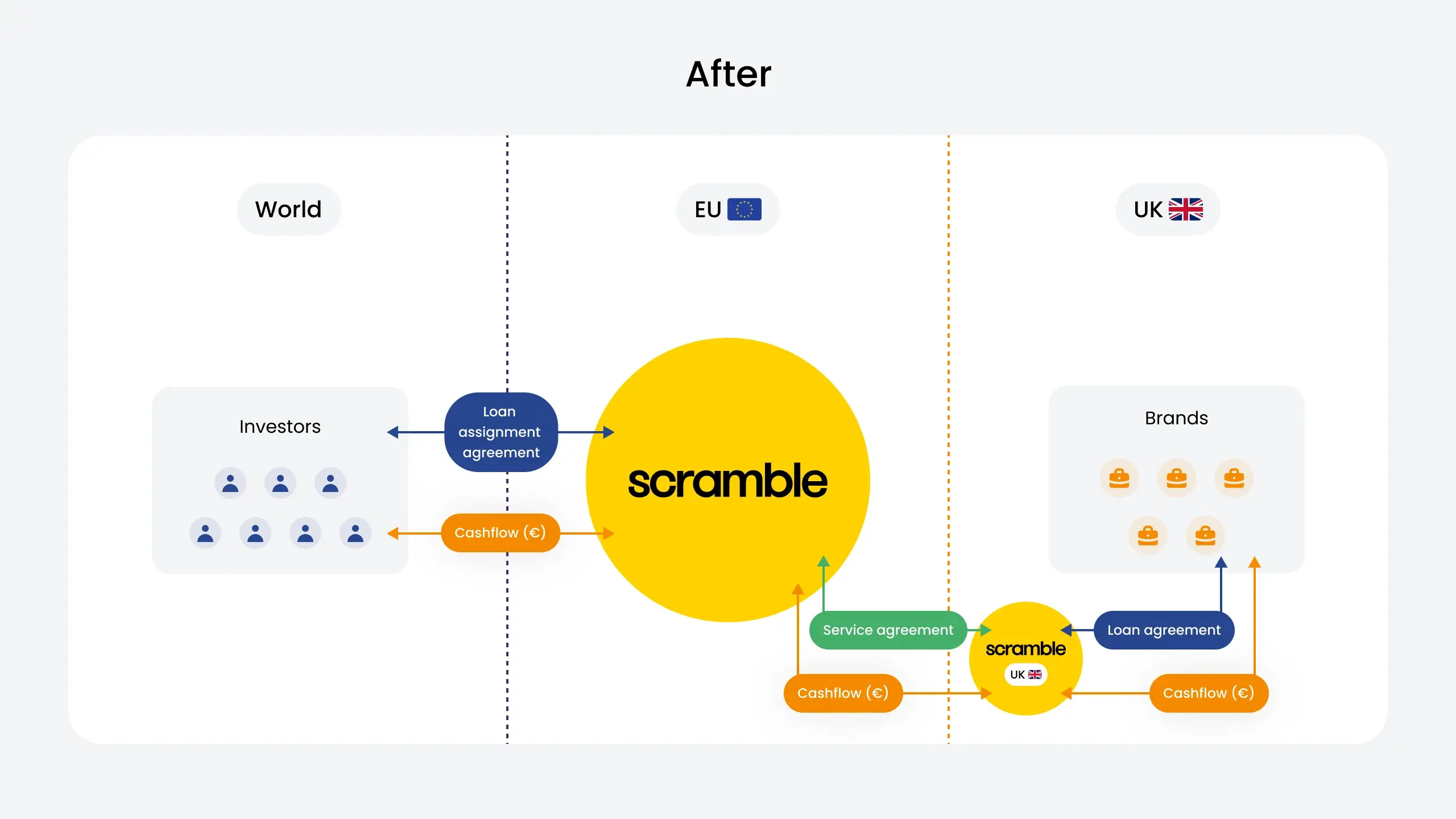

To provide transparency and clarity on the changes, we have prepared a visual representation comparing our previous business model with the upgraded one. Two images will illustrate the evolution of our terms, highlighting the enhancements made in favour of investor protection.

Sсheme 1: Investing inherently carries risks, and despite meticulous brand selection, the unpredictability of markets meant brands could face financial challenges. Legal restrictions in different jurisdictions added complexity.

Scheme 2: To address these challenges, we've introduced a new 'loan assignment' model by establishing Scramble UK, a lending organization. Under this setup, Scramble UK directly lends to businesses in the jurisdiction of the brands.

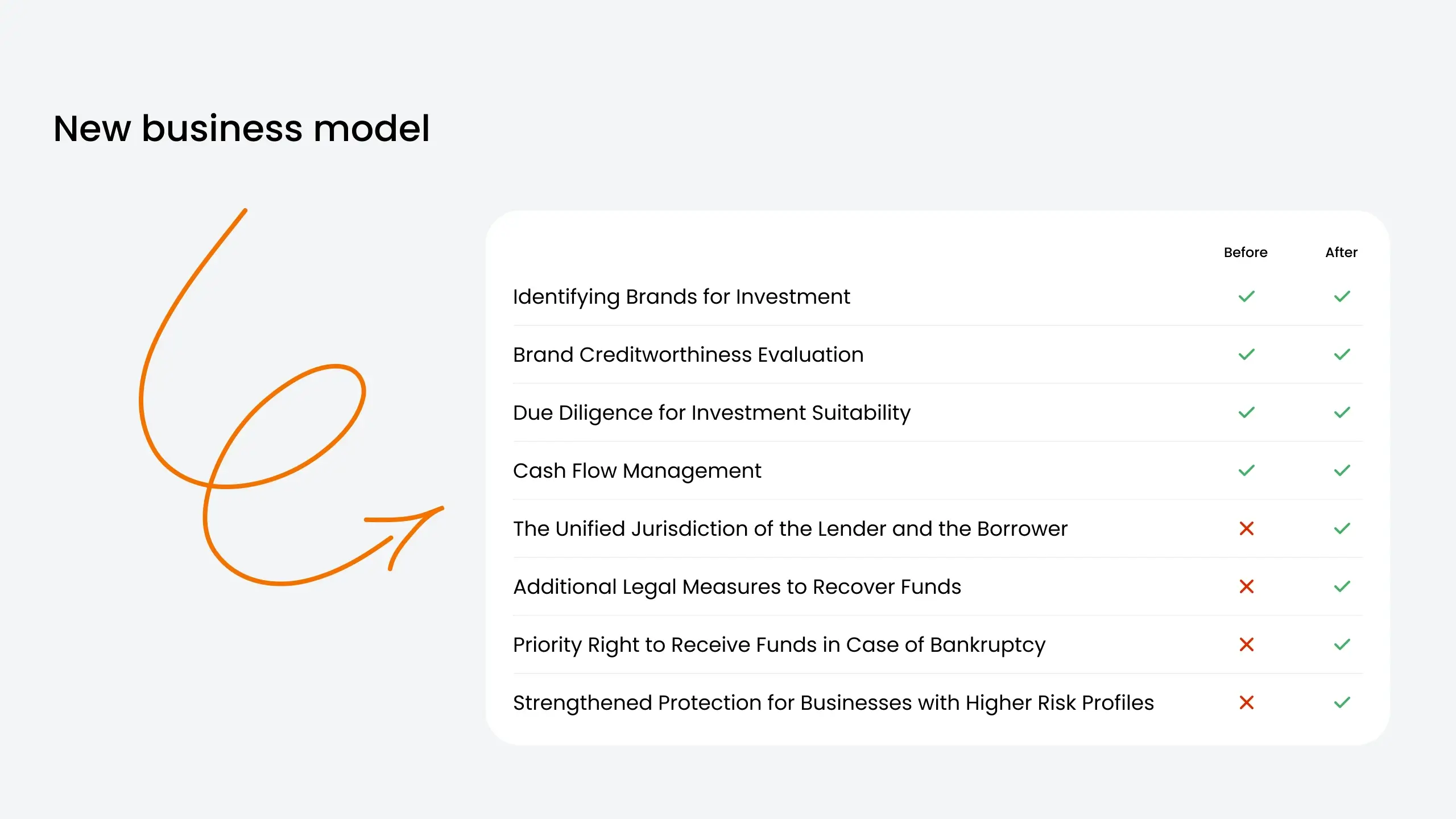

This significantly broadens the horizon for legal interactions with the brands. Simultaneously, Scramble remains actively engaged in the selection and valuation of brands and cachet, ensuring continuity in our commitment. A comparison between the two schemes reveals that investors now enjoy superior protection for their funds, namely:

Scramble is committed to ongoing improvements, ensuring our investors' funds are more secure. We've swiftly implemented the new business model, with the next round scheduled under this updated structure from January 5, 2024. The recent implementation of our new loan assignment model won't disrupt your investor experience. We've maintained consistency in financial terms, batches, interface, and monthly repayments. The changes are confined to legal documentation, ensuring a seamless day-to-day experience for our investors. We hope these changes will prove useful in better protecting the investors’ funds over time.

Thank you for being part of our journey towards a more secure investment experience.